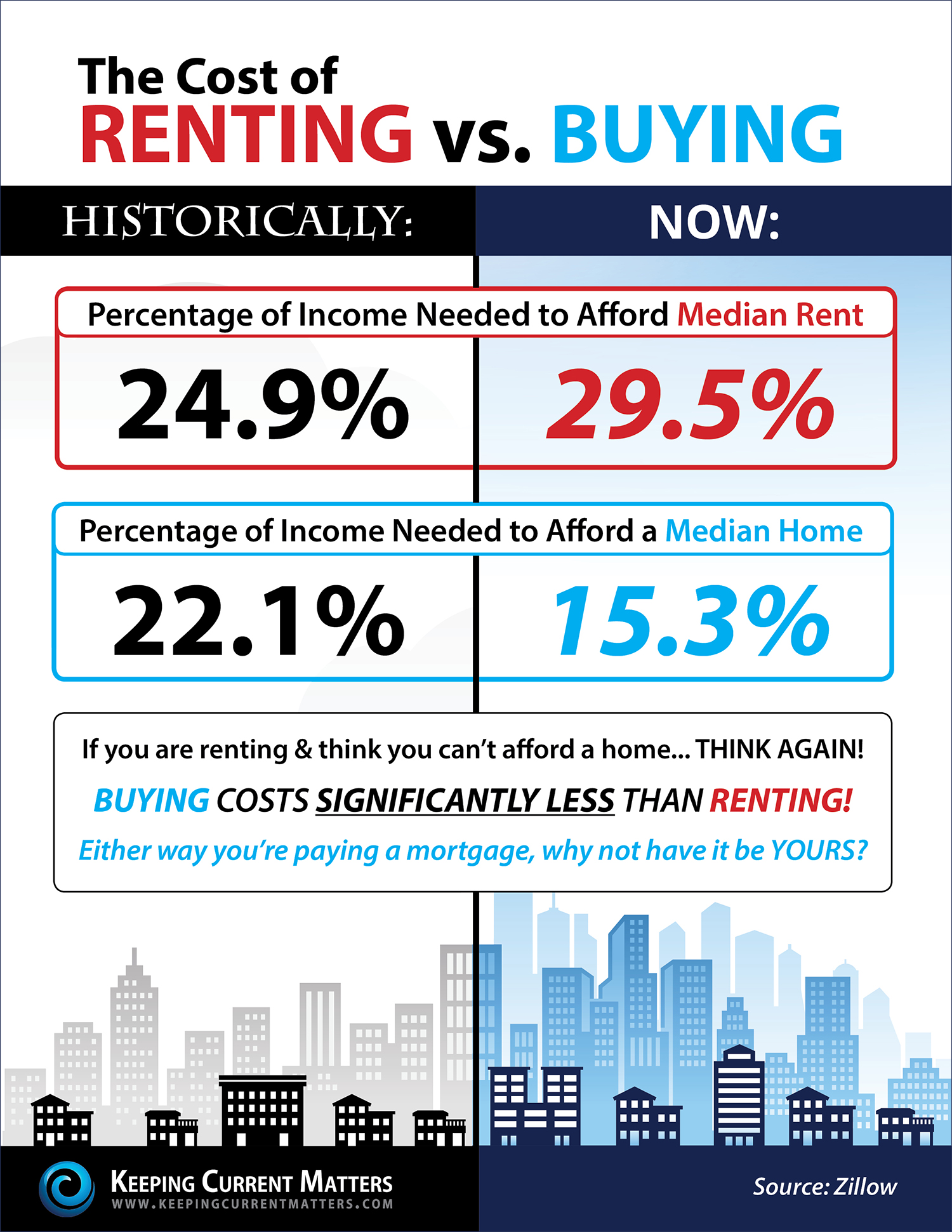

REDUCE RENT: With rents rising, many people are forking over 30% or more of their paychecks every month. Moving to a cheaper location, downsizing, or taking in a roommate could drop your rent substantially, which you'll be happy about when you're eventually paying rent to yourself.

AUTOMATIC SAVING: Setting up automated savings contributions with your employer, even if it's only a small percentage, will add up over time while hardly even being noticable in the short-term.

DON'T SPLURGE: The average tax refund in 2014 was $3116 and it's expected to rise in 2015. This year, try holding off on the 70 inch tv and put some of your refund towards your down payment savings.

DONT SAVE FOR RETIREMENT: Just kidding, do that. But if you're already contributing 6% of your paycheck to your 401k and you have an employer match, consider the benefits of putting any additional savings towards buying a home of your own.

ASK: in 2013, 27% of first time buyers received gift funds from family or friends. Under the 2015 annual gift tax exclusion law, it is now legal for any individual to gift $14,000/year tax-free. Have 2 parents? Double that. Throw in a spouse and you've got the ability to receive $56,000 tax-free every year. Might be worth a conversation.

http://www.zillow.com/blog/strategies-saving-for-down-payment-168290/

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link